Corporate Venturing

for the Global 5000

Corporate Innovation Funds

Overview.

Development of a customized Corporate Venture Capital (CVC) program to drive your growth & prevent disruption. In your Corporate Innovation Fund, we will work with you to develop an ideal strategy then bring innovative companies that match your Objectives into the portfolio. Common Objectives.

Common Objectives.

• Create growth options by taking stakes in interesting companies.• Gain a window into what technologies and business models will be the winners.

• Improved access to innovation, new technology and disruptive changes.

• More predictable R&D at lower costs than internal development (then double down or buy out winners).

• Profitably leverages your existing scale, distribution and relationships into additional value.

Industry Examples

There are over 1,300 partially or fully outsourced corporate venture funds, and over 250 with full-time staff such as IBM Venture Capital, Kaiser Permanente Ventures, Dow Venture Capital, Siemens Venture Capital, Deutsche Telekom T-Venture, BP Ventures, Unilever Corporate Ventures, Swisscom Ventures, Bosch Venture Capital, Google Ventures, etc. Note that we are not affiliated but have relationships with many.

Types of Investments

The ideal portfolio balances strategic and financial goals:

The ideal portfolio balances strategic and financial goals:1. Ecosystem Investments. Helps develop new customer segments, complementary products, or enablers/precursors to drive your revenue growth.

2. Innovation Investments. Provides improved access to key business innovation with the intent of acquiring the most promising for competitive advantage.

3. Emergent Investments. Develops adjacencies or new models to provide alternative strategy options if the winning market models change.

4. Harvest Investments. Taking stakes in synergistic startups that reap an advantage from your manufacturing, distribution, servicing, IP or brand assets.

5. Insight Investments. Leverages your deep industry knowledge, relationships and insight to pick more likely winners than other investors are able.

Common Criteria

• Provides a double bottom line -- both financial and strategic returns.• Investment and involvement presents a win-win for your company and the target companies.

• The investment is related and able to make a material impact on your core business or future growth.

Our Unique Advantages.

1) Far more experience..We have helped facilitate over 250 investments, far more than any other corporate venturing group partners by an order of magnitude.

2) Higher Quality of Deals.

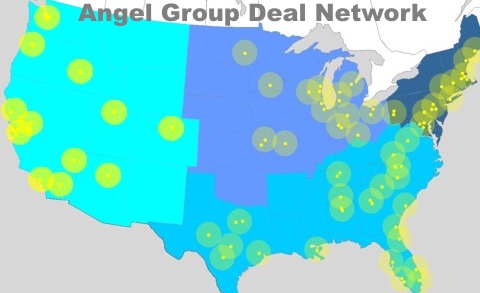

A far larger deal pipeline allows us both more selectivity and far better matching to your strategy and objectives. We are part of the world's largest deal syndication network involving over 200 angel groups. Membership in Executive Angels gives you access and visibility to many of the very best deals regardless of location instead of being limited.

3. Better Path to Exits.

On companies you decide not to acquire, since most angel exits are by acquisition rather than IPO we are part of a key network which provides access to corporate development executives from most of the top tech acquirers. This helps our companies with more early exits opportunities and also helps these acquirors with visibility into future risers and disruptors (win-win). The AngelPool Exits Advisory Board includes companies such as Amazon, eBay, Electronic Arts, FaceBook, Google, HP, Intuit, PayPal, Salesforce, SAP, Tivo, Yahoo! and many more.

On companies you decide not to acquire, since most angel exits are by acquisition rather than IPO we are part of a key network which provides access to corporate development executives from most of the top tech acquirers. This helps our companies with more early exits opportunities and also helps these acquirors with visibility into future risers and disruptors (win-win). The AngelPool Exits Advisory Board includes companies such as Amazon, eBay, Electronic Arts, FaceBook, Google, HP, Intuit, PayPal, Salesforce, SAP, Tivo, Yahoo! and many more.Additional Articles & Events.

- BCG Study on Corporate Venturing Trends (pdf)- WSJ Article on Corporate Venturing Trends (pdf)

- Corporate Venturing Conference (each Feb in Newport Beach)

- Global Corporate Venturing Symposium (each May in London)

- EVCA Corporate Venture Capital Summit (each Feb in Brussels)

Contact Us for a Free Consultation

Contact Us for a Free ConsultationServices

3. Corporate Innovation Funds

3. Corporate Innovation Funds

Back to Overview

Back to Overview