Corporate Venturing

for the Global 5000

Corporate Accelerators

Overview.

Grow and manage an ecosystem of complimentary startups within your industry or adjacency to accelerate innovation and gain a competitive advantage.Objectives.

• Find next generation products in your industry that you can help commercialize.• Create an ecosystem of users and customers for your key products.

• Drive innovation at a much faster pace than is possible internally.

• Create growth options by taking stakes in interesting companies.

• Gain a window into what technologies and business models will be the winners.

• Profitably leverages your existing scale, distribution and relationships into additional value.

Industry Examples

There now exist over 200 corporate accelerators such as the Siemens Technology Accelerator, Nike+ Accelerator, Citrix Startup Accelerator, Turner Media Camp Academy, Microsoft Accelerator, Volkswagen Technology Accelerator, Kaplan Accelerator, Pearson Catalyst and many more.

* Note that we are not affiliated with some of the programs above.

How They Often Work.

Two or three classes (enclaves) comprised of innovative startup companies are planned each year. Each admitted company gets an investment and intensive mentoring in exchange for a stake in that company. Common ranges include camps lasting 4-20 weeks, 8-20 companies per enclave, initial investments of $5K-$100K for equity ranging between 5-20% of each startup. The location is typically chosen to maximize the most innovative applicants such as Silicon Valley or the city that is the strongest in your industry, or your HQ location if in a strong city with these characteristics and if wished we can often plan it in conjunction with a university interested in strengthening that part of their business programs. Partnerships and distribution agreements are common outcomes for the more interesting companies by the class conclusion.

Two or three classes (enclaves) comprised of innovative startup companies are planned each year. Each admitted company gets an investment and intensive mentoring in exchange for a stake in that company. Common ranges include camps lasting 4-20 weeks, 8-20 companies per enclave, initial investments of $5K-$100K for equity ranging between 5-20% of each startup. The location is typically chosen to maximize the most innovative applicants such as Silicon Valley or the city that is the strongest in your industry, or your HQ location if in a strong city with these characteristics and if wished we can often plan it in conjunction with a university interested in strengthening that part of their business programs. Partnerships and distribution agreements are common outcomes for the more interesting companies by the class conclusion.Our Unique Advantages.

The three most important success factors to a productive corporate accelerator are:1) The quality of the admitted startups/entrepreneurs.

2) The strategic matchup synergies with the company.

3) Post class funding to fuel the growth of the startups.

We have built the largest deal flow system in North America with over 23,000 startups applying per year. This allows us to screen more selectively for quality, and also ensures enough applicants to ensure a better matchup with strong strategic synergies.

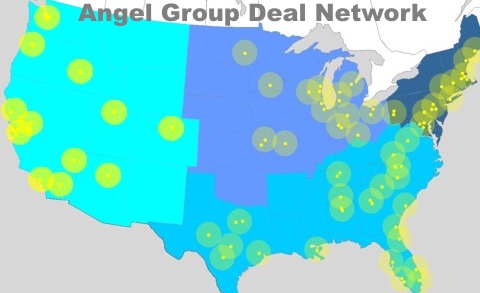

After the classes are run, we have directly relationships with over 5,000 angels in over 200 angel groups where the startups will have the very best chance of getting additional funding to drive their growth (especially when there is a meaningful corporation endorsing that startup).

Additional Articles & Conferences.

• Business Week article on accelerators• Article on Nike and Microsoft accelerators

• Yearly conference of university startups and accelerators

Contact Us for a Free Consultation

Contact Us for a Free ConsultationServices

4. Corporate Accelerators

4. Corporate Accelerators

Back to Overview

Back to Overview