Corporate Venturing

for the Global 5000

Technology Spinouts

Overview.

Harvesting of technology created internally for capturing maximum value.Objectives.

• Harvest maximum value from unique assets developed by your company.• Generate cash that can be reinvested into other strategic areas to drive growth.

• Free the spun out company from restrictions or barriers for improved focus.

• Monetize non-core innovations and opportunities.

Examples

Examples

VMware from EMC, Agilent from HP, Guidant from Eli Lilly, Coach from Sara Lee, Chipotle from McDonalds, Expedia from IAC, Orbitz from Cendant, Discover from Morgan Stanley, VDO from Siemens, Idearc from Verizon, over a thousand yearly just in North America.Our Unique Advantages.

• Exceptional experience mentoring and bringing over 250 startups to market yearly.• Stronger angel and venture capital ties for growth capital than any other group.

• Network of joint ventures and alliances to jumpstart and fortify the spin-out.

Our Eight Step Process.

1) Assess the IP, Assets, Talent, Market, then report the potential.2) Work with the parent to solidify the spin-out leadership team.

3) Develop a viable business plan with the leadership team.

4) Finalize tax efficient structure, finances, and full management team.

5) Transfer IP, staff, and other assets needed to operate.

6) Officially launch and communicate the spin-out.

7) Help drive growth and support tasks such as growth capital.

8) Drive the exit or liquidity event for the parent.

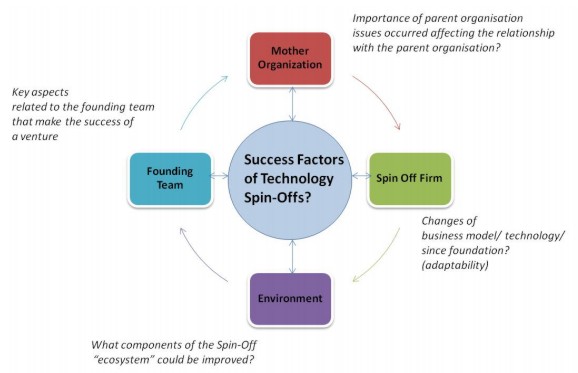

Four Key Focus Aspects.

More Books and Articles.

• Book: Success Factors of Corporate Spin-Offs• Book: Spin-Off to Pay-Off

• Article on Spin-Offs

Contact Us for a Free Consultation

Contact Us for a Free ConsultationServices

5. Technology Spinouts

5. Technology Spinouts

Back to Overview

Back to Overview